September 2020

September 2020

If you own a home there is always a need to spend money. It may be for repairs, renovations or utilities. Over time it may be necessary to replace windows, furnace or a roof.

Owners of condominiums are no different. While the nature of expenses, how they are paid and who makes these decisions may differ, there remains an ongoing need to maintain the home. Condo fees, when set at the proper level, should pay all expenses for maintaining the home.

There are times when unexpected expenses come up or work becomes necessary sooner than expected and additional funds are needed. Homeowners rely on savings or loans to cover these expenses. Condo communities do the same with additional options available to them.

Reserve funds are based on the premise that each owner should pay for what they have used. Doing so creates a fund to replace what must be replaced. When sufficient funds have not been set aside, borrowing money and repaying it through higher condo fees is necessary. It means owners pay for what they have used in the past plus what they are currently using. The need to set aside money for future replacement remains and can only be achieved by increasing condo fees.

Decisions on how to obtain funds to pay for condo corporation expenses are made by the board.

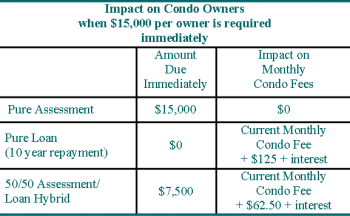

One option is the special assessment – a set amount of money payable by each owner in the community. It may not always be realistic for all condo owners to come up with necessary funds in a relatively short period of time.

An alternative to the special assessment is to borrow money from a bank or other institution to be repaid with interest. Funds for repaying this loan are provided by owners in the form of higher condo fees.

Condo corporations typically borrow money when they have a large capital requirement and insufficient funds in their reserve fund. This may be for roof replacement, underground garage repairs or elevator replacement. Borrowed money covers any shortfall between what is needed and what has been saved. It may be the reserve fund is sufficient to pay for necessary work but would deplete funds set aside for other purposes. Borrowing the money offers a practical solution.

One advantage of borrowing money rather than implementing a special assessment is that it has no impact on an individual’s personal credit. When condo owners borrow money to pay a special assessment, their ability to do so is dependent on many factors including debt level and credit score. Those with high debt or lower credit score will find it harder to borrow money.

Condo fees will increase in order to pay for a loan. A 40 percent increase in fees could pose a problem. A 10 percent or 15 percent increase may be considered manageable. Condo owners should be aware of why the loan is necessary, how it will impact on condo fees and for how long. A clear explanation of what happens if no loan is obtained – likely a very large special assessment that some may be unable to pay – can be helpful.

Borrowing is not an approach recommended to prepare for future projects or expenses. Higher condo fees or a special assessment are better ways to deal with future expenditures that avoid the costs of borrowing money.

Borrowing decisions should be evaluated before entering into any long-term financial arrangement.

- When are funds needed? Borrowing funds can be advantageous when there is insufficient time to raise them from owners.

- How much is needed? Consider how much condo fees will have to increase to pay the loan. Increases higher than 10 percent to 15 percent can be unmanageable for more owners. Combining a smaller loan with a special assessment may be a better approach.

- What is the purpose of the loan? Loans are more appropriate for one-time projects. Borrowing to pay recurring expenses does not address the underlying problem of unreasonably low condo fees.