January 2018

Underfunded reserve funds are a reality. Less clear is how many reserve funds are underfunded.

The reality is that condo corporations struggle to undertake projects costing hundreds of thousands of dollars. With the growing number of condo buildings now over 30 years old, and the oldest now being about 50 years old, there is a growing number of projects that can cost millions of dollars. These include elevator replacement, window replacement, façade repair and garage work. This major work can present a considerable challenge to condo corporations with underfunded reserve funds.

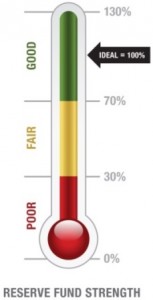

One US study of reserve funds which analyzed over 30,000 reserve fund studies prepared between 1992 and 2012 found that 70% were underfunded. In this study, underfunding refers to a reserve fund where the amount of money is less than 70% of the amount required to pay for identified work.

This estimate is consistent with estimates of reserve fund strength coming out of British Columbia.

Understanding Full Funding

Reserve funds are fully funded when a condo corporation is on track to obtain necessary funds by the time they are required. Perhaps a roof replacement is anticipated in 2018 to be needed in 2029 at a cost of $1,000,000. Each year the condo corporation needs to set aside $100,000 so that they have $1,000,000 when the roof needs to be replaced. So long as $100,000 is set aside each year the roof replacement is fully funded.

Reserve funds are fully funded when a condo corporation is on track to obtain necessary funds by the time they are required. Perhaps a roof replacement is anticipated in 2018 to be needed in 2029 at a cost of $1,000,000. Each year the condo corporation needs to set aside $100,000 so that they have $1,000,000 when the roof needs to be replaced. So long as $100,000 is set aside each year the roof replacement is fully funded.

The same approach is taken for each item in a reserve fund study which may contain hundreds of items. The reserve fund balance is a sum of the individual items in the reserve fund study and a weighted average of each item’s anticipated years to replacement.

When the condo corporation contributes the proper amount of money each year for each item in a reserve fund study, the reserve fund remains fully funded.

Some condo corporations adjust their funding expectations by modifying the rate of inflation, anticipated return on invested funds or when building components are expected to require replacement. They can also choose to omit some items from a reserve fund study. Overly optimistic estimates on these factors can produce a ”fully funded” reserve fund inadequate to pay for major expenditures.

Short-term relief from lower condo fees is not worth the problems as condo buildings age.