June 2018

June 2018

Foreigners secretly buy the majority, and best, condo properties and are the cause of recent price increases throughout the city. This is the fiction some have chosen to believe.

A Window Into the World of Condo Investors, jointly published by Urbanation and CIBC, provides data about who is purchasing condo properties. According to this report, condo purchasers are more likely to be local immigrants between 40 and 60 who have purchased property as a presale to help their children or as an investment. They typically rent out the property for a number of years to help pay down principal.

The report highlights risks in condo investing. Condo investors can lose more than $500 per month when renting a property. Price appreciation, despite being strong for the past couple of years, is unlikely to compensate for these monthly losses.

Among the findings in this report:

Among the findings in this report:

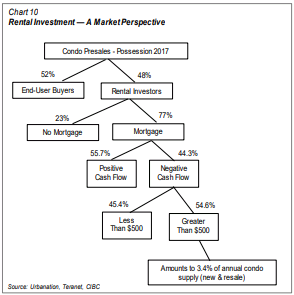

- Of all condo units purchased in the GTA last year, 48% were purchased by speculators – local investors intending to resell at a higher price.

- About 10% of condo investors are international buyers.

- Just over 20% of condo investors purchased the property with no mortgage.

- 44% of investors with a mortgage that took possession in 2017 are in a negative cash flow position – rental income less than mortgage payment (principal + interest) and condo maintenance fees. Among investors with positive cash flow, average monthly net income was about $360. Excluded from these amounts are closing costs, land transfer taxes, property taxes, taxes on rental income and repairs. Cash flow position presumes these properties are never unrented.

Read A Window Into the World of Condo Investors or click here for pdf file.