September 2019

September 2019

Your building is over 35 years old. The condo board has done an excellent job of setting condo fees so equipment is properly maintained and replaced as necessary. Energy efficient upgrades have been implemented. Common areas are well-maintained and elevators have recently been replaced.

Overall the building is in excellent condition. Everyone agrees the board has done an exceptional job.

After 30 years condo buildings tend to show their age. Now is the time for really large expenditures. The building façade and windows may require replacement at a cost of up to $6 million. Roof replacement may cost an additional $1 million.

This is a situation common to many condo communities built prior to 1990 and what all condo corporations need to prepare for from the beginning. A $2 million reserve fund, despite being substantial, is not sufficient for this purpose.

Running a condo corporation involves more than collecting condo fees, building a reserve fund and employing a management company. It requires an understanding of how much money is and will be needed, how it should be spent and when. Many condo boards, despite the best of intentions, lack experience managing on this scale.

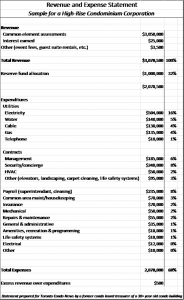

The best condo boards learn from experience. Financial statements presented here are for a 35 year old 24-storey condo building comprised of 250 units. The building includes a full complement of common areas including swimming pool, whirlpool and sauna; fitness centre; party room; guest suites; meeting rooms; and outdoor garden. Weekly activities include yoga, movies and card games.

The best condo boards learn from experience. Financial statements presented here are for a 35 year old 24-storey condo building comprised of 250 units. The building includes a full complement of common areas including swimming pool, whirlpool and sauna; fitness centre; party room; guest suites; meeting rooms; and outdoor garden. Weekly activities include yoga, movies and card games.

Condo corporations are surprisingly similar. Most have comparable major costs and maintenance requirements. Some expenses are proportional – they change among buildings based on the building population. Larger buildings have higher elevator-related costs because there are more elevators. Proportionately these expenses remain similar to buildings of different sizes. Other expenses are more fixed. A superintendent costs the same regardless of building size or number of residents.

Condo Fees – Revenue

After estimating corporation expenses for the upcoming fiscal year condo fees are set so revenue approximates these expenses plus an allocation for the reserve fund. Adjustments may be necessary based on prior surpluses or deficits, or to set aside funds for specific future use.

Reserve Fund Allocation

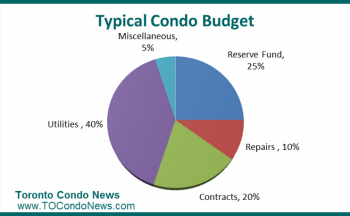

Most buildings fail to maintain an adequate reserve fund in the range of 33 percent. A new building begins with no money in the reserve fund and few reserve fund expenditures. After five years reserve fund expenditures begin to increase. After 20 years these expenditures likely exceed what is in the reserve fund unless condo fees were set at a proper level from the beginning and about 33 percent of the fees were allocated. Inadequate condo fees and reserve fund levels require compensating fund infusions in the form of dramatic annual increases, special assessments and condo loans. Setting condo fees at a proper level from the beginning, and allocating a proper amount to the reserve fund each year, is typically more economical, provides fewer surprises and conflicts, and facilitates a more enjoyable lifestyle.

Once the condo budget has been established for the year, multiply all anticipated expenses by 1.33 to determine total expected costs plus reserve fund allocation. Condo fees for that year can then be established using the final calculation.

Utilities

Utilities are typically the highest expenditures for a condo corporation. Electricity will be higher than all others. Cost reduction efforts that fail to reduce these costs will have limited effect. Submetering and energy efficiency initiatives are nearly always effective at reducing utility costs.

Contracts

Full service condominium management for a high-rise building typically includes one full-time condominium manager and an assistant. Some communities rely on a single individual, possibly less than full-time, to reduce costs. Technology can help maintain levels of service and quality when utilized effectively.

Security/Concierge cost is based on single-person 24 hour coverage seven days a week. Some communities may not require evening or weekend coverage at lesser cost without compromising security. Security cameras, fobs or access cards, and remote concierge services all offer ways to help keep a building safe and secure without additional staffing.

Mechanical, Repairs & Maintenance, Insurance

Excessive insurance claims and low deductibles can cause insurance costs to escalate. Regular maintenance pays dividends in the form of improved lifestyle, fewer problems, lower maintenance costs and reduced insurance costs.