July 2023

July 2023

Special assessments always come as a shock to condo owners who can be required to pay six-figure bills for overdue maintenance projects. Ontario’s Condo Act protects against most of these shocks.

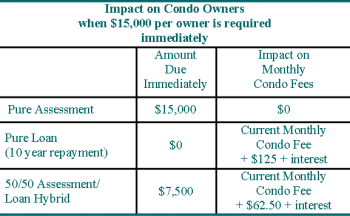

Harbor Towers, on the Boston waterfront, assessed owners about $15,000 US per unit in the 1990s to replace windows and waterproof the building. They then assessed owners between $120,000 US and $400,000 US each to repair the building’s heating and cooling system and corroded pipes. This was not an isolated case. Another condominium corporation had a $38 million special assessment to replace a heating system amounting to about $50,000 US per unit. A third community assessed owners an average of $160,000 US to replace garage flooring, a brick exterior and emergency generator.

Throughout the United States, condominium corporations implement special assessments known only to affected owners. Governments rely on residential communities to self-regulate except for fire safety and exterior inspections every few years.

In Canada, British Columbia requires condominium corporations to prepare depreciation reports comparable to those of Ontario’s reserve fund studies. In that province, corporations are not required to undertake necessary work identified in these reports. This has resulted in some having assessments of $40,000 to $80,000 per suite.

In Ontario, like elsewhere, assessments are a reality of condominium corporations where owners are expected to maintain their unit and share of common area expenses. This can be expensive but no different than what is required by owners of single-family homes.

Ontario offers protections against the majority of special assessments and their higher amounts elsewhere. Special assessments must be disclosed in the status certificate when a unit is sold. In the United States a condo owner is not required to disclose when a special assessment has been made or is expected. Another difference is that Ontario condominium corporations are required to maintain a reserve fund that alleviates the need for most special assessments. Properly budgeted and maintained, condominium corporations in Ontario can avoid the need for any special assessments so long as their board is paying attention and operating in a responsible manner.

Special assessments are the cost communities pay for poor management and bad budgeting practices. They are avoidable through good management and proper budgeting.