January 2023

January 2023

Reserve funds are only as good as the calculations used to derive their value.

It is not uncommon for a reserve fund to be established at a level of 10 percent of condo fees. The formula may remain stable for a number of years or increase based on general inflation rates. This becomes a recipe for disaster virtually ensuring future problems and dramatic fee increases.

Choosing a percentage value of condo fees, while sufficient for complying with certain requirements, does not ensure there are sufficient funds to meet ongoing expenses. Manipulation of assumptions, from incorrect inflation or interest rates to failing to recognize all future expenditures at a reasonable level, contribute to continued underfunding.

“The only correct way to maintain a reserve fund is to base it on a reserve fund study continually updated to reflect changing circumstances and current information” explains Henry Jansen of Criterium-Jansen Engineers which specializes in conducting reserve fund studies. “That initial reserve fund study prepared for a new community is likely to undergo dramatic changes as omitted items are added and people live their lives. This is the only way to ensure funds are available when major capital projects become necessary while continuing to fund ongoing equipment and system replacements along with operational repairs and maintenance.”

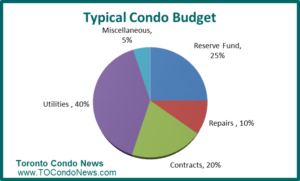

More typically, reserve fund contributions for a stable community can represent 30 to 40 percent of condo fees when the operating fund is maintained without a deficit.