March 2020

March 2020

Despite being bad form to read the last page of a book first, a condo corporation’s audited financial statements are best read from back to front.

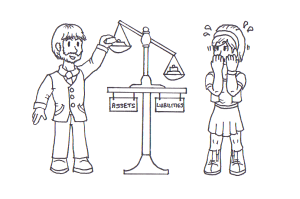

Early pages of a condo corporation’s audited financial statements include Profit and Loss Statement, Statement of Financial Position (Balance Sheet), and Statement of Reserve Fund Operations. The numbers shown on each line of these documents can represent dozens, hundreds or thousands of individual transactions. Good and bad information can blend together to produce bland.

It is in the notes, at the back of audited financial statements, where the best information can reside. This is where you learn about large contracts and other financial commitments; anticipated financial losses that may occur; lawsuits against the condo corporation; and large future projects.

The auditor’s report includes an opinion on whether the statements are free of material misstatement. If there is no reservation of opinion, statements are adequately presented. This opinion does not suggest that a condo corporation is in good financial shape or that it is managed properly. A qualified opinion means some information or documentation was unavailable to the auditor. No explanation is provided as to why documentation was unavailable. It could have been misplaced or hidden from the auditor. A qualified opinion may signify disorganization, poor record keeping, lax accounting standards or fraud.

The auditor’s report includes an opinion on whether the statements are free of material misstatement. If there is no reservation of opinion, statements are adequately presented. This opinion does not suggest that a condo corporation is in good financial shape or that it is managed properly. A qualified opinion means some information or documentation was unavailable to the auditor. No explanation is provided as to why documentation was unavailable. It could have been misplaced or hidden from the auditor. A qualified opinion may signify disorganization, poor record keeping, lax accounting standards or fraud.