February 2021

February 2021

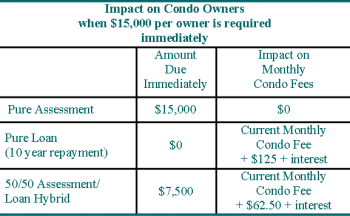

Increasingly loans are used by condominium corporations managing older buildings to spread out the cost of major projects. This can allow a community to undertake necessary work without a special assessment or significantly increasing condo fees, or to spread increases over a number of years.

Loans are a way to supplement the reserve fund. When major expenditures occur earlier than expected, or are more costly than anticipated, the reserve fund may be inadequate. It may not be practical to delay a project until funds are available. Windows may be falling out, water entering from a leaking roof or façade, or elevators failing. Some systems may have been failing for years and now in need of emergency replacement. Regardless of reason, the work needs to be complete sooner than can be accommodated with the current reserve fund.

There may be financial savings from undertaking work sooner and borrowing the money to do so.

A loan can reduce the amount of a planned special assessment and ensure a reserve fund is not depleted. Condo loans can be repaid in future years, after major upgrades are complete, when no major expenditures are anticipated.

Any decision to borrow money should compare the financial alternatives of borrowing, special assessment and increasing condo fees. See Special Assessment vs. Condo Loans in the Condo Archives for one way to make this comparison.

The financial position of each condominium corporation is unique. The best solution for any community is dependent on its current situation, past actions and future plans.