February 2017

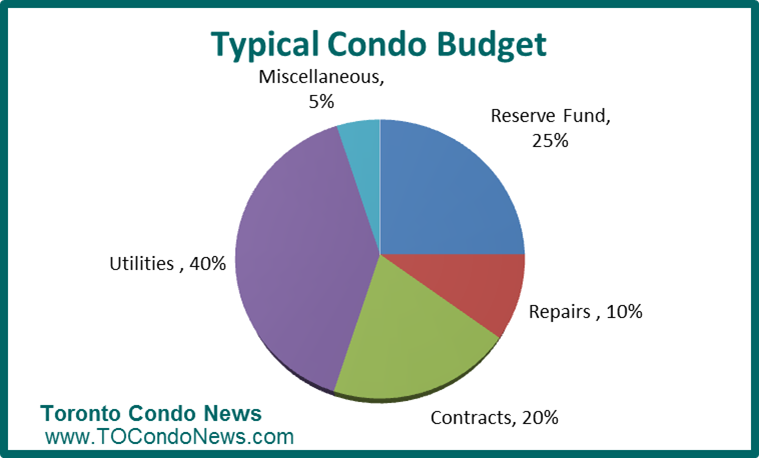

When it comes to understanding and managing condo budgets it is helpful to look at the major expenditure areas. Doing so helps to understand which aspects of condo corporation expenditures may be over -or under-funded.

When it comes to expenses condo corporations are surprisingly similar. This allows one corporation to gauge their operations by comparing against other condo corporations. One way to doing this is to look at the condo budget in percentage terms as presented in the accompanying chart.

Utilities

Utilities can account for up to 40% of a condo corporation’s annual revenues. The percentage is highest for condo corporations where electricity use is not sub-metered for each suite. There are two ways to reduce these expenditures. One is to reduce energy consumption by improving common area infrastructure. An energy audit, usually undertaken by an engineering firm that specializes in this area, can help identify initiatives that can help reduce these expenditures. Sub-metering, for those condo corporations that have not yet done so, remains the most effective way to reduce in-suite utility consumption.

Contracts

Contracts can account for about 20% of a condo corporation’s annual revenues. Primary contracts are for property management, security, superintendent, cleaning and cable. Eliminating or reducing services for any of these contracts can have a significant positive impact on a condo budget.

Repairs

Repairs, accounting for an estimated 10% of a condo corporation’s annual revenues, are essential to the proper functioning of the building. Reducing repair budgets will provide a short-term benefit to the budget and possible minor reduction in condo fees. It is likely a short-term solution resulting in higher repair costs soon afterward plus increased pressure on the reserve fund.

Reserve Fund

Reserve fund contributions can account for about 25% of a condo corporation’s annual revenues. Funding below this level is likely to require increased reserve fund contributions in the not-to-distant future.

The reserve fund provides funds for replacement of building elements including roof, elevators, boilers and HVAC systems. It also supports periodic refurbishment of common areas including hallways, lobbies and amenity spaces.

A healthy reserve fund for a mature condo corporation, one that is at least ten years old, is one with a balance in excess of annual condo corporation revenues. A building that is 20 -30 years old may require a reserve fund balance that is double that of annual condo corporation revenues.

Justifying a smaller reserve fund balance is one way to reduce condo fees or “find” money for other uses. Doing so compromises the financial stability of a condo corporation and risks future financial pressures.

Miscellaneous

Miscellaneous expenditures generally account for the smallest portion of a condo budget, about 5%. They are frequently the most visible expenditures to residents and consume the greatest portion of a condo board’s time. This category often includes social and event programming, building parties, communications and anything that does not fit into the other classifications.

Condo boards intent on managing their budget and controlling expenditures should place their focus on the largest portions of the pie chart. Those that focus attention on the more visible expenditures, the miscellaneous category, are likely to find a negligible impact on the budget inconsistent with the loss of communication and social activities that are a presumed part of condo living for many condo communities.