May 2023

May 2023

The dramatic increase in inflation and supply chain struggles have played havoc with condominium corporation finances. The Residential Building Construction Price Index increased by 35 percent in the GTA over the two-year period from Q1 2020 to Q4 2021. Reserve fund studies are updated every three years at which time reserve funds need to reflect three years of cost increases. The Consumer Price Index (CPI), which many condominium corporations rely on when estimating their future costs, was 6.7 percent in March 2022 and currently remains at a comparable level.

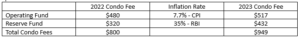

Higher expenses impact on condo fees. Here we look at the impact of these cost increases for a community trying to establish their monthly condo fees for 2023. We look at the impact of cost increases for a single unit paying $800 each month with 60 percent going toward operating expenses and the remainder going to the reserve fund. Assuming the condominium corporation was adequately funded prior to 2020, 2022 and 2023 fees would look like this.

This is an annual increase of 18.6 percent.

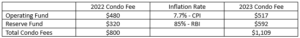

We know that many communities are not fully funded, and that these calculations do not fully capture all cost increases. The Auditor General of Ontario and others estimate that many will need to increase their reserve fund contribution by 50 percent to make up for past underfunding. Incorporating an additional 50 percent to reserve fund contributions changes condo fees in this way.

This is an annual increase of 38.6 percent.

Financial pressures are likely to extend through 2023 and likely into 2024, and deferring work to keep costs low only increases condo fees by a greater amount a few years later.

As each community works through this process, those which have ensured condo fees reflect the costs of maintaining their home will be in a stronger position. Those communities where fees have been maintained at an unnaturally low level will have no choice but to increase their revenues through some combination of higher monthly fees, special assessments, and possibly a condo loan, as the only way to rebalance the relationship between condo fees and actual expenditures.