July 2021

July 2021

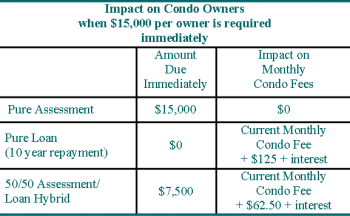

When condominium corporations require money they have a few options.

- Increase Monthly Condo Fees

- Special Assessment

- Borrow Money

Increasing monthly condo fees is easiest in that it is at the discretion of the board. The most common time to do this is at the beginning of a fiscal year. The budget shows how much is likely needed for the upcoming year. Any increase in fees can be designed to cover an anticipated deficit in the operating or reserve fund account.

Special assessments are a consideration when required funds are to pay for nonrecurring expenditures. This avoids a more permanent increase in fees owners are required to pay.

Borrowing money offers immediate cash infusion which must be repaid along with fees. It can be desirable when funds are required immediately or when owners may be unable to pay what is necessary to cover expenses.

A borrowing by-law may be desirable when borrowing money. One benefit is that it documents how much money is needed and for what purposes. It may be required by a lender prior to their advancing funds. Unlike other forms of borrowing no security, mortgage or lien is required.

Implementing a Borrowing By-law

- An engineering opinion should be obtained about the need to complete projects for which there are insufficient funds. The board would typically approve the projects as being necessary and obtain pricing from contractors.

- Lenders are contacted to obtain financing based on pricing provided by contractors.

- Lenders likely provide a commitment letter detailing the amount to be provided and terms inclusive of interest rate, amortization, and repayment options.

- A borrowing by-law is drafted by corporation lawyers and approved by the board for presentation to owners.

- A meeting is called to address the borrowing by-law if not presented at the annual general meeting. Questions about the project, loan and by-law are addressed at this time.

- If approved by owners, the by-law is executed then registered at the Land Registry Office (LRO) against all units.

- The board works with the lender to ensure funds are advanced when required.