June 2020

June 2020

Budgets are likely in flux because of covid-related actions.

Delayed maintenance may have required higher expenditures these past few months, or later in the year. Cancellation of in-suite repairs, such as water damage on ceilings or damaged window seals, may be causing building-wide problems. More residents not working, and spending more time at home, may be using more electricity, gas and water. Cleaning costs may have increased.

Owners may not be paying some, or all, their condo fees. This situation may continue for an indeterminate and extended period.

Communities in need of funds may look to their reserve fund. While it may seem convenient to use reserve fund contributions to cover a financial shortfall, doing so is ill-advised. Reserve funds are not to be used for operating expenses which likely includes all covid-related expenditures. For communities insisting on do so, they must first develop a new reserve fund plan to ensure their reserve fund is not depleted and remains available for its intended use.

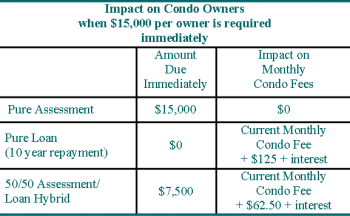

Borrowing money is an option. Section 56(3) of the Condo Act states “A corporation shall not borrow money for expenditures not listed in the budget for the current fiscal year unless it has passed a by-law … “. Compliance with the Condo Act requires that a by-law be passed which requires a vote of owners.

As an alternative, a budget can be revised to reflect added expenditures and/or reduced revenues. Condo boards have authority to revise the budget to reflect dramatic or unanticipated revisions to expenses, or revenue changes possibly from deferral of condo fees. Revising a budget requires a new Periodic Information Certificate (PIC) be issued and a new budget sent to owners. Borrowing should be limited to items reflected in the then-current budget.

As an alternative, a budget can be revised to reflect added expenditures and/or reduced revenues. Condo boards have authority to revise the budget to reflect dramatic or unanticipated revisions to expenses, or revenue changes possibly from deferral of condo fees. Revising a budget requires a new Periodic Information Certificate (PIC) be issued and a new budget sent to owners. Borrowing should be limited to items reflected in the then-current budget.

A revised budget could create a deficit to be repaid in future years unless there is a prior surplus or contingency fund to draw on. Any deficit could be funded by borrowing money.