July 2023

July 2023

This has been a challenging year for condominium management, directors and owners dealing with rising costs. In Condo Fee Increases in 2023 we reported that communities “may require condo fee increases of 15 percent or more to maintain current levels of maintenance, staffing and services.” In Catching Up with Inflation we reported that an 18.6 percent increase in condo fees would be necessary to avoid the need for reductions in operations. For communities with an underfunded reserve fund and condo fees that are too low, the necessary increase is likely to be in the range of 38.6 percent.

The best approach to communicating fee increases is full transparency. Many condo boards are uncomfortable with condo fee increases and prefer hiding the truth while complying with required legal disclosures.

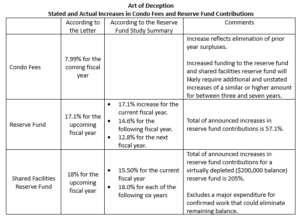

One local condominium community shows how this is done. They announced that fees were increasing by 7.99 percent, which appears to be low compared to the above guidelines. Other documents provide a clearer picture for those choosing to read and understand what is provided.

Condo fee increases are typically announced in writing prior to a new fiscal year. Owners receive a Budget Letter showing their monthly assessment for the coming fiscal year and the percentage increase in assessments. Accompanying documentation would typically include a Periodic Information Certificate and the Annual Budget. If a reserve fund study was recently completed, this package is likely to include summary documents showing reserve fund contribution increases and estimated balances by year. It is in these documents where the truth can be found.

Budget Letter

The local condominium community announced an increase in condo fees of 7.99 percent for the coming fiscal year along with increased contribution levels to both the reserve fund and a shared facilities reserve fund. This is an indication that prior contribution levels have been inadequate due to poor fiscal planning. Both reserve funds have likely been underfunded for years and these increases appear to be an effort to avoid financial collapse. Incomplete detail in the letter makes this unclear.

The Budget

The budget contains rows of numbers that most quickly scan to compare 1) current year actual spend with the budget, and 2) coming year budget with prior year actual. Lines showing large changes will be identified by owners and questions asked. While helpful, this fails to show how expenses and revenues are likely to change over multiple years. They fail to identify deficiencies in the reserve fund or operations budgets.

Summary of the Reserve Fund Study

After a reserve fund study has been completed and approved by the board, a summary is provided to owners. Before reviewing this document, be aware of your building’s current age and reserve fund balance. Consider that a high-rise building of about 17 to 24 storeys could require $15 million or more to replace major components once it reaches 30 to 35 years old. While building your reserve fund to this level, there can be years where annual reserve fund expenditures exceed contributions.

Contributions to the reserve fund, announced as increasing by 17.1 percent, are actually increasing by 57.1 percent over a three-year period!

The announced 15.5 percent annual increase is actually an astounding 205 percent increase over seven years according to the Reserve Fund Study Cash Flow Table!

The local condominium community was informed that fees were increasing by 7.99 percent. The board has chosen to remain silent regarding increases in 2024 and 2025 shown in the Reserve Fund Study Cash Flow Table. Contributions to the reserve fund, announced as increasing by 17.1 percent, are actually increasing by 57.1 percent over a three-year period! This is intended to grow the reserve fund from approximately $2 million to more than $15 million. For the shared facilities reserve fund, which is virtually depleted, the announced 15.5 percent annual increase is actually an astounding 205 percent increase over seven years according to the Reserve Fund Study Cash Flow Table!

Periodic Information Certificate (PIC)

The Periodic Information Certificate must be delivered to owners twice during the corporation’s fiscal year, within 60 days of the end of the first and third fiscal quarters. It includes information on finances, reserve fund, budget and insurance, and names of current board members. The PIC is of little value in understanding the financial state of your condominium corporation.

Back to the Budget Letter

The letter announced that fees are increasing by 7.99 percent for the upcoming fiscal year. Unstated but evident from reserve fund documents is that a comparable increase will be necessary for the following two years if announced higher reserve fund contributions are to be ensured. This suggests an increase of 25.9 percent over three years. Considering the current financial situation, there are likely to be further and unstated cost increases.

The letter for this local community is accurate in all respects while failing to explain primary reasons for the increase and other important details. Owners will learn the truth as it unfolds in the coming years. The board’s ability to present a credible financial plan has been compromised.

Sliding into Disaster

It is a misconception to believe that financial problems occur quickly. It takes years of financial mismanagement before problems become obvious, owners recognize them and decide to take action.

For the local condominium community, these documents present a quantifiable indication of financial distress. There can no longer be credibility behind statements that the corporation is in a “strong financial position” and that their reserve fund is adequately funded.

This local condominium community appears to have run out of money. Their future is likely to include both visible and unnoticed reductions in quality of staffing, maintenance, cleanliness, security and internal system problems. Elevators may break down more frequently and take longer to repair. Quality of life and general home maintenance problems will increase and take longer to be resolved. Better management services and managers will demand a premium or possibly refuse to work for the condominium corporation.

The condominium corporation has time to fix their finances if they recognize the problem. Otherwise, they may soon reach the point of a neighbouring building that has run out of tricks and is rumoured to have implemented a $30,000 special assessment