April 2020

April 2020

As a not-for-profit organization, condo corporations are not supposed to make a profit. This does not mean they can’t have a surplus.

The budget is a prediction of revenues and expenditures for the fiscal year based on past experience and expectation. At the end of the year actual revenues and expenditures can be as estimated, in surplus or deficit.

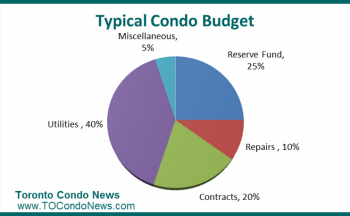

The budget balances a desire to keep condo fees as low as possible while having sufficient funds for all expenses including reserve fund allocations. There may be an additional goal of setting aside funds for specific projects in future years. A large project may require multiple surplus years before sufficient funds are available to proceed particularly when it cannot be funded through the reserve fund.

A special assessment may result in a surplus. It may be that more money was collected than required. Perhaps repair or replacement costs were lower than estimated.

A surplus cannot be reimbursed to owners. The Condo Act allows these funds to be applied against future common expenses or paid into the reserve fund. No other use is allowed. Only when a corporation is terminated can any surplus be reimbursed to owners.