June 2023

June 2023

Each year, condominium owners are provided with their corporation’s audited financial statements and a two-page opinion letter. These financial statements are important, a necessary part of condominium governance, and limited in scope.

Owners, when reviewing their financial statements, look for a healthy reserve fund and a positive cash flow balance as signs that a condominium corporation is reasonably managed.

Why the audit is required

The Condo Act requires that condominium corporations undertake an annual audit. Owners and prospective owners have more confidence in financial data when it is audited.

Every condominium corporation with more than 25 units must have their financial statements audited annually. Those with fewer than 25 units can choose not to have an audit if all owners have consented in writing to waive this requirement.

Condo Act Requirements

The Condo Act exists to protect consumers. Consistent with this, the audit is required to ensure compliance with the Condo Act, particularly with regard to finances.

The Condo Act exists to protect consumers. Consistent with this, the audit is required to ensure compliance with the Condo Act, particularly with regard to finances.

One requirement is that two bank accounts be maintained. One is an operating account. Money flows into this account primarily when condo fees are paid but can include other revenues such as fees for use of a party room, elevator or rental suites. Funds flowing from this account are expenses for maintaining the building and community on a daily basis, otherwise known as day-to-day operating expenses.

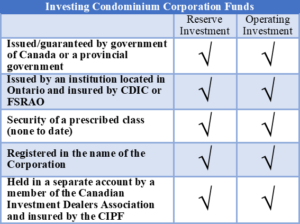

The second required account is to ensure reserve fund monies are not being used for daily operations. Reserve fund inflows are that portion of condo fees intended for this purpose. Most of the reserve fund money is not immediately needed so can be invested. Typically, invested funds have staggered maturity dates to ensure funds are available when needed. Types of investments are restricted to ensure the principal amount is not lost. Excess cash in the operating account must be convertible to cash within 90 days

Both accounts must be in the name of the corporation.

Another requirement is that the corporation must have an investment plan completed after conducting a reserve fund study and prior to investing any monies. This is to ensure funds are available when needed.

The Condo Audit is required to provide a reasonable degree of assurance that requirements as stated in Section 115 of the Condo Act are being followed.

Appointment of an Auditor

Appointment of an auditor is the responsibility of unit owners per Section 60 of the Condo Act. This occurs at the annual general meeting (AGM). An auditor then holds office until the next AGM.

Roles of Auditor, Management and Directors

A condominium audit is a financial audit to ensure that whatever amounts were paid by the condominium corporation are properly recorded in the financial statements. The auditor’s role is to obtain a reasonable assurance that the provided numbers are reliable and to offer an opinion on this.

The auditor looks at corporation procedures and a sampling of records prior to providing their opinion which is based on reasonableness. They focus on the riskier areas of financial operations which, for condominium corporations, is reserve fund expenditures.

Management and directors are tasked with performing accounting and record keeping, and to issue financial statements.

The Condo Audit differs from other types of audits

The Condo Audit is not a performance audit which reviews physical infrastructure and is typically conducted by an engineer.

The Condo Audit is not a value-for-money audit which deals with cost control or efficiency. It is unlikely to review the quality of a reserve fund study, project future cash requirements, or the quality of oversight over assets.

The Condo Audit is not a fraud investigation. This responsibility lies with directors and management. If concerns are noted by the auditor, they will be identified to the board and questions would likely be asked. Further steps may be taken depending on responses.

The Condo Audit is not a test of internal controls or review of all processes. The mandate of a condo audit is to review some of this but not to test or address them. Recommendations or comments may be provided.

In short, a Condo Audit is intended solely to ensure compliance with the Condo Act.

The Audit Process

The corporation is required to maintain records and to make them available for examination. These are records to document and back up all the money received and spent including bank statements, records of deposits and payments. There should be a deposit slip for all monies provided to the corporation. Many condominium corporations only accept payment of fees by cheque or electronic means to ensure proper records. For other revenues such as fees for rental of spaces, there should be a log book or other records showing when spaces were used and fees paid.

The audit process begins when the corporation receives its’ engagement letter early in its fiscal year. The audit occurs at least 45 to 60 days after the fiscal year end. This allows time for record keeping to be completed.

After records are reviewed, questions are asked by the auditor and answered by the board or management. Receivables (money owed to the corporation) more than 90 days late, significant changes from prior year or projections, legal issues, and related party transactions (financial dealings between directors and the corporation) are all red flags an auditor is likely to inquire about. When cash is accepted, an auditor is likely to advise against doing so because of the many risks. Monies paid by cheque or electronic methods are more easily trackable and less likely to be stolen or lost. The corporation is asked if they have a documented investment plan. If not, the auditor will note this in their letter.

Once the Condo Audit is complete, a letter is sent to management and directors for their signature(s) of approval for the final audited statements.

Then final audited statements and report are issued.

The entire audit process can take about a month. In practice, the deadline for delivering final audited financial statements to owners is about six weeks prior to the AGM.

Audit Report

The Audit Report is a two-page letter intended to ensure best practices are followed and that potential improvements in financial processes are made. This letter is distributed to owners along with the financial statements.

The Audit Report is a two-page letter intended to ensure best practices are followed and that potential improvements in financial processes are made. This letter is distributed to owners along with the financial statements.

The goal of a Condo Audit is to receive an unqualified or clean report. This means that the financial statements are fairly stated and there are no concerns.

A qualified opinion means the auditor provided an unqualified or clean opinion on everything except for certain items that are stated. A qualified opinion may identify cash revenues they are unable to verify. Condo Act contraventions may be noted. A reserve fund study may not have been updated. Reserve fund contributions may not be in accordance with the reserve fund study.

A disclaimer means the auditor is unable to provide an opinion. Books or records expected by the auditor were limited or unavailable.

An adverse opinion is rare. This means the financial statements misstate or misrepresent and do not accurately reflect the corporation’s records. Owners should not rely on them.

Impact on the Annual General Meeting

It has been common for the auditor to be present at Annual General Meetings for a ten-to-twenty-minute presentation of financial results and to answer questions from attendees. Increasingly, there is a reluctance among auditing firms to have someone to appear at these meetings. Some no longer offer this option while others charge an additional fee for this level of service.

The Condo Audit provides a basic check ensuring the condominium corporation has complied with requirements of the Condo Act. It does not normally, nor is it intended to, address other aspects of building or management operations such as level and adequacy of a reserve fund, director competency, fraud, loss of money, efficiencies or accuracy of a reserve fund study.