August 2020

August 2020

Despite the current popularity of electronic forms of money, cash remains widely popular. For many it is trusted more than any other form of money including credit and debit cards, cheques and electronic forms. Perhaps one of its greatest advantages is that it is anonymous and leaves no paper trail.

Money is how we store our wealth for future use. Some store their money in banks or investment accounts. Others prefer to store their money some pace they feel is safe; in a safe, behind walls, in a mattress or in a hole in the ground.

Electronic funds offer convenience. They can also be easier to trace, access and steal.

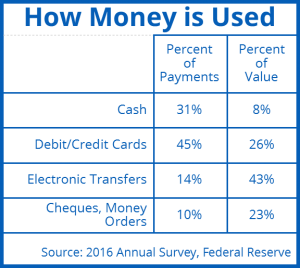

Debit and credit cards are the most common way to make most payments. Cash accounted for an estimated 31 percent of payments and 8 percent of value in 2016 according to a survey by the Federal Reserve (USA). More heavily used were debit and credit cards accounting for 45 percent of all payments and 26 percent of value. Electronic transfers accounted for 14 percent of payments and 43 percent of value.

Cash tends to be used for payments under $25. Credit and debit cards are generally used for payments of $25 to $100. Transfers are most common for transactions of $100 or more.

Many communities choose not accept cash for payment of condo fees. Acceptance of electronic transfers, an increasingly popular form of payment for amounts in the hundreds of dollars, is low. Accommodating electronic transfers would be consistent with how many prefer to pay their condo fees.

Surprisingly, there appears to be an increasing number of large dollar value bills in circulation suggesting that more are choosing to store their money in a personal safe, behind a wall or in the ceiling, or beneath the floor.